SPOTLIGHTED PODCAST ALERT (YOUR ARTICLE BEGINS A FEW INCHES DOWN)...

WWE announced Thursday the latest WWE Network subscriber count, as well as key business figures and investment plans related to the Network in their Third Quarter 2015 earnings release.

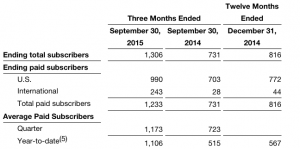

As of the end of the Third Quarter 2015 (September 30), WWE had 1.233 million paid subscribers, up seven percent from 1.156 million at the end of the Second Quarter (June 30).

The total breaks down as 990,000 domestic paid subscribers and 243,000 international paid subscribers. During the quarter WWE added 51,000 domestic paid subscribers (5 percent of the increase).

Also, average paid subscribers was 1.173 million at the end of the quarter and 1.106 million year-to-date. The figures are up and down compared to last quarter.

– Avg. Paid Q3: 1.173 million, down from 1.216 million in the Q2 report.

– Avg. Paid Year-End: 1.106 million, up from 1.072 million in the Q2 report.

In their financial report, WWE compared the Third Quarter Network subscriber figures to the ramp-up period in Third Quarter 2014, based on their belief that it’s more important to focus on year-over-year growth than “sequential” changes.

However, investors appear to be more focused on quarter-to-quarter Network growth, especially when WWE did not provide guidance on 2016 expectations. This is reflected in a pre-market stock sell-off driving the stock price down 7-10 percent early Thursday morning.

In the report, WWE touted significant TV Revenue growth over the next 2-4 years as their domestic and international deals ramp-up. The next paragraph was not as promising for the Network:

“Regarding WWE Network, given the inherent uncertainty of this nascent and growing business, management will not provide guidance for 2016 subscriber levels.”

WWE followed with a comparison to Netflix’s revenue model as a potential benchmark: “If the average paid subscribers to WWE Network increased at a rate within this range in 2016, management currently estimates WWE’s overall revenue could grow approximately 5-10 percent driven primarily by the increase in network subscribers and the escalation of television rights fees.”

Financial executive George Barrios said during the quarterly conference call that they believe Netflix’s domestic subscription model most closely resembles their business for an “apples to apples” comparison.

– WWE noted their emphasis on new content in Fourth Quarter 2015 leading into 2016 to try to drive Network subscriptions and retention.

Notably, WWE plans to continue offering live event specials. WWE announced that the MSG Network special was “the network’s most-watched program to date,” excluding Sunday night PPV events.

Also, the “Beast in the East” Japan special and the NXT: Brooklyn special “were among the Network’s top programs” during the third quarter, WWE disclosed.

Plus, WWE will continue offering NXT: Takeover specials, which McMahon noted have “done extremely well for us.”

– WWE’s official “five-part strategy” to grow the Network breaks down as: (1) adding 90 hours of original content in Q4-2015, (2) using social media to acquire and retain subscribers, such as releasing the “Breaking Ground” premiere episode on YouTube and Facebook, (3) introducing new features to the Network player, (4) distributing the Network in more markets, and (5) expanding distribution platforms.

This will cost money, which Barrios acknowledged during the conference call. Barrios said the investment in new content is not completely necessary, as WWE believes they could grow subscribers without significant investment, but they look at new content as having a “long tail” – new content in 2015/2016, then having a permanent residence in the tape library for 2017 and beyond.

Specific to new markets, WWE noted the expansion to India on November 2. Next up are Japan and Germany in January 2016. WWE also said they are working on plans for China, Thailand, and Philippines.

Barrios said in the conference call that China is tricky because the entertainment market has “changed more in the last 12 months than the previous 20 years.” Barrios said they have been in China since 2007, but they’re receiving new data on the ground floor as the market constantly changes.

Regarding Germany, Barrios said the issue is Germans are not used to paying for content because of how their TV system is traditionally structured. So, WWE is unsure how consumers will receive the Network, which is why they tried to gather as much research as possible before launching in Germany.

– A significant Network-related item that popped up on WWE’s conference call Powerpoint presentation is the issue of “Network churn,” or subscribers entering and exiting. The churn greatly increased in the Second and Third Quarters compared to the same periods in 2014.

This was mainly due to subscribers being locked into a six-month commitment in 2014 and the current period offering trial periods that allow subscribers to come and go as they please. That has impacted WWE’s ability to retain subscribers, slowing down growth to a single-digit percentage each quarter in the current Year 2.

In the second quarter, the Network gained 337,000 subscribers, but lost 508,000 subscribers for a net loss of 171,000 subscribers. This was the period after WrestleMania.

In the reported third quarter, the Network gained 453,000 subscribers, but lost 376,000 subscribers for a net gain of 77,000 subscribers.

Barrios was asked what WWE is doing to address the churn rate. Barrios pointed to WWE needing to change two behaviors among audience members. (1) People are used to selecting PPV events they want to watch because of the high price-point on pay-per-view – the idea of breaking 30-year-old viewing habits. (2) The message has not been received by everyone, including “passionate fans” that PPVs are now available on the Network for $9.99/month.

Barrios said WWE believes once they change habits and behaviors, they can bring the churn down.

Key Figures Break Down

– Total Subscribers (Pay & Trial): 1.306 million. (Five percent of the total are free trial subscribers.)

– Total Pay Subscribers: 1.233 million (up 7% from 1.156 million in Q2-2015).

– Domestic Paid Subscribers: 990,000 (up 5% 930,000 in Q2-2015).

– Int’l Paid Subscribers: 243,000 (up 12% from 217,000 in Q2-2015).

– Network Churn: 453,000 new subscribers; 376,000 lost subscribers – net gain of 77,000 subscribers.

– Avg. Paid Subscribers: 1.173 million at quarter-end (down 3.5% from 1.216 million in Q2-2015).

– Avg. Paid Subscribers: 1.106 million at year-end (up 3.1% from 1.072 million in Q2-2015).

WWE released the following table comparing Q3-2015 Network performance to Q3-2014, which was during the initial ramp-up period that makes current Network figures pop out.

WWE said during their quarterly conference call that they emphasize year-over-year performance over “sequential” performance in the Network area, which seems to point to a disconnect with investors who are looking more at the station-to-station performance.

Leave a Reply

You must be logged in to post a comment.